Federal income tax rates and brackets

You pay tax as a percentage of your income in layers called tax brackets. As your income goes up, the tax rate on the next layer of income is higher.

When your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. You pay the higher rate only on the part that's in the new tax bracket.

For a single taxpayer, the rates are:

| Tax rate | on taxable income from . . . | up to . . . |

|---|

| 10% | $0 | $11,000 |

| 12% | $11,001 | $44,725 |

| 22% | $44,726 | $95,375 |

| 24% | $95,376 | $182,100 |

| 32% | $182,101 | $231,250 |

| 35% | $231,251 | $578,125 |

| 37% | $578,126 | And up |

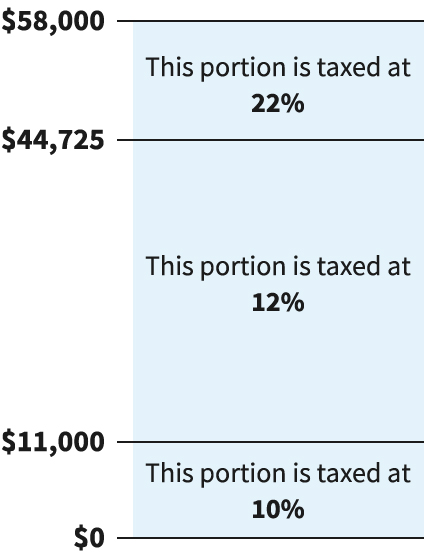

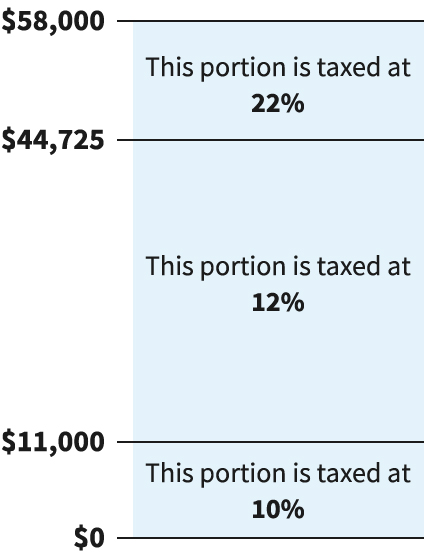

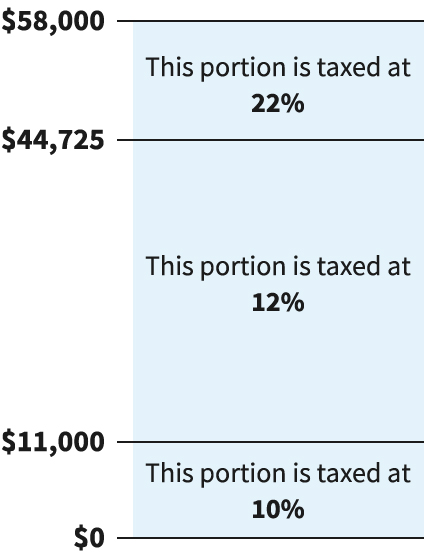

Here’s how that works for a single person earning $58,000 per year:

for a single person earning $58,000 per year. Income from

for a single person earning $58,000 per year. Income from  for a single person earning $58,000 per year. Income from to $11,000 is taxed at 10%. Income from $11,001 to $44,725 is taxed at 12%. Income from $44,726 to $58,000 is taxed at 22%." width="424" height="555" />

for a single person earning $58,000 per year. Income from to $11,000 is taxed at 10%. Income from $11,001 to $44,725 is taxed at 12%. Income from $44,726 to $58,000 is taxed at 22%." width="424" height="555" />

to $11,000 is taxed at 10%. Income from $11,001 to $44,725 is taxed at 12%. Income from $44,726 to $58,000 is taxed at 22%." width="424" height="555" />

2023 tax rates for other filers

Find the current tax rates for other filing statuses.

| Tax rate | on taxable income from . . . | up to . . . |

|---|

| 10% | $0 | $22,000 |

| 12% | $22,001 | $89,450 |

| 22% | $89,451 | $190,750 |

| 24% | $190,751 | $364,200 |

| 32% | $364,201 | $462,500 |

| 35% | $462,501 | $693,750 |

| 37% | $693,751 | And up |

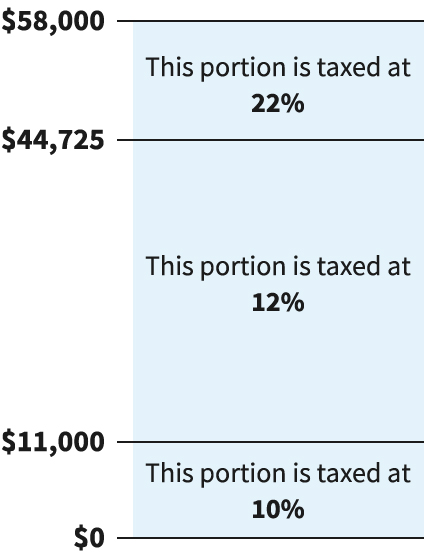

for a single person earning $58,000 per year. Income from

for a single person earning $58,000 per year. Income from  for a single person earning $58,000 per year. Income from to $11,000 is taxed at 10%. Income from $11,001 to $44,725 is taxed at 12%. Income from $44,726 to $58,000 is taxed at 22%." width="424" height="555" />

for a single person earning $58,000 per year. Income from to $11,000 is taxed at 10%. Income from $11,001 to $44,725 is taxed at 12%. Income from $44,726 to $58,000 is taxed at 22%." width="424" height="555" />