A forward rate agreement (FRA) is a cash-settled OTC contract between two counterparties, where the buyer is borrowing (and the seller is lending) a notional sum at a fixed interest rate (the FRA rate) and for a specified period of time starting at an agreed date in the future.

An FRA is basically a forward-starting loan, but without the exchange of the principal. The notional amount is simply used to calculate interest payments. By enabling market participants to trade today at an interest rate that will be effective at some point in the future, FRAs allow them to hedge their interest rate exposure on future engagements.

Concretely, the buyer of the FRA, who locks in a borrowing rate, will be protected against a rise in interest rates and the seller, who obtains a fixed lending rate, will be protected against a fall in interest rates. If the interest rates neither fall nor rise, nobody will benefit.

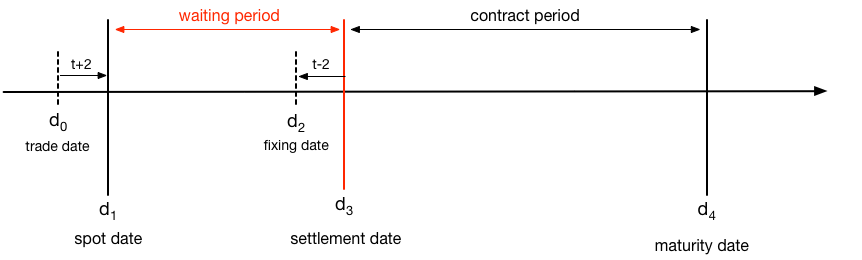

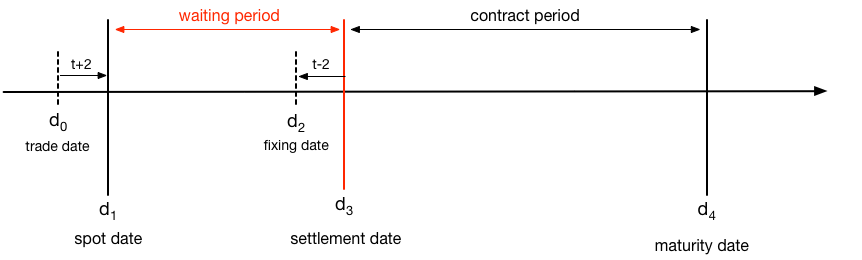

The life of an FRA is composed of two periods of time – the waiting period, or forward, and the contract period. The waiting period is the period up until the start of the notional loan and may last up to 12 months although durations of up to 6 months are most common. The contract period spans the duration of the notional loan and can also last up to 12 months.

The FRA however effectively ends with the settlement date, as there is no longer any contractual engagement between the two counterparties once the settlement amount has been paid. The contract period is merely one of the calculation parameters used to determine the settlement amount (FRAs are off-balance sheet instruments).

Below a short listing of the terms used for the different elements and events of an FRA:

| contract rate (or FRA rate) | The interest rate the two contracting parties negotiate on trade date. This rate will be compared to the settlement rate when calculating the settlement amount. It starts on the settlement (d3) date and ends on maturity date (d4) |

| contract period | The time between the settlement date and maturity date of the notional loan. This period can go up to 12 months. |

| currency | The currency in which the FRA's notional amount is denominated. |

| fixing date | This is the date on which the reference rate is determined, that is, the rate to which the FRA rate is compared. |

| FRA buyer | By convention, the buyer of an FRA is the contracting party that borrows at the FRA rate (contract rate). |

| FRA seller | By convention, the seller of an FRA is the contracting party that lends at the FRA rate (contract rate). |

| master agreement | Usually, counterparties sign a master agreement between each other before entering into an OTC contract because doing so without a master agreement in place would mean huge amounts of paperwork having to be generated and processed for each single deal. |

| maturity date | The date on which the notional loan is deemed to expire. |

| notional amount | This is the notional sum for which the interest rate will be guaranteed and on which all interest calculations will be based. |

| reference rate | The interest rate index the FRA rate will be compared against in order to determine the settlement amount. This will generally be an IBOR-type rate index with the same duration as the FRA's contract period. (for example 6-month EURIBOR for an FRA in euros with a 6-month contract period). |

| settlement amount | The amount calculated as the difference between the FRA rate and the reference rate as a percentage of the notional sum, paid by one party to the other on the settlement date. The settlement amount is calculated after the fixing date, for payment on the settlement date. |

| settlement date | The date on which the notional loan period (the contract period) begins and on which the settlement amount is being paid. |

| spot date | The date on which the FRA. Usually two business days after the trade date. |

| trade date | The date on which the FRA is negotiated between the two counterparties. |

| waiting period | The period comprised between the value date (d1) and the settlement date (d3). |

The amount to be exchanged on settlement date - the settlement amount - is calculated as described below. For the sake of clarity, the calculation has been split into two parts, but normally it is one single calculation.

The interest differential is the result of the comparison between the FRA rate and the settlement rate. It is calculated as follows:

Interest differential = | (Settlement rate − Contract rate) | × (Days in contract period/360) × Notional amount

As stated above, the settlement amount is paid upfront (at the start of the contract period), whereas interbank rates like LIBOR or EURIBOR are for operations with interest payment in arrears (at the end of the loan period). To account for this, the interest differential needs to be discounted, using the settlement rate as a discount rate. The settlement amount is thus calculated as the present value of the interest differential:

Settlement amount = Interest differential / [1 + Settlement rate × (Days in contract period ⁄ 360)]

If the settlement rate is higher than the contract rate, then it is the FRA seller who has to pay the settlement amount to the buyer. If the contract rate is higher than the settlement rate, then it is the FRA buyer who has to pay the settlement amount to the seller. If the contract rate and the settlement rate are equal, then no payment is made.

The complete formula used to calculate the settlement amount is the following:

\[ S=C \cdot \frac <\left ( r_- r_ \right ) \cdot \frac<\left (d_Point on the formula to see its legend

FRAs are money market instruments, and are traded by both banks and corporations. The FRA market is liquid in all major currencies, also by the presence of market makers, and rates are also quoted by a number of banks and brokers.

The format in which FRAs are noted is the term to settlement date and term to maturity date, both expressed in months and usually separated by the letter "x".

2x6 - An FRA having a 2-month waiting period (forward) and a 4 month contract period.

6x12 - An FRA having a 6-month waiting period (forward) and a 6 month contract period.

FRA are quoted with the FRA rate. Thus, if an FRA 2x8 in US dollars quotes at 1.50%, and a future borrower anticipates the 6-month USD Libor rate in two months being higher than 1.50%, he should buy an FRA.

An FRA can be used for different purposes:

A corporation learns that it will need to borrow 1 000 000 $ in six months' time for a 6-month period. The interest rate at which it can borrow today is 6-month LIBOR plus 50 basis points. Let us further assume that the 6-month LIBOR currently is at 0.89465%, but the company’s treasurer thinks it might rise as high as 1.30% over the forthcoming months.

The treasurer choses to buy a 6x12 FRA in order to cover the period of 6 months starting 6 months from now. He receives a quote of 0.95450% from his bank and buys the FRA for a notional of 1 000 000 $ on April 8th.

| Trade date | 08/04/2016 | |

| Spot date (t+2) | 12/04/2016 | |

| Fixing date | 10/10/2016 | |

| Settlement date | 12/10/2016 | |

| Maturity date | 12/04/2017 | Contract period: 182 days |

| FRA rate | 0.95450% |

On the fixing date (October 10th, 2016), the 6-month LIBOR fixes at 1.26222, which is the settlement rate applicable for the company's FRA.

As anticipated by the treasurer, the 6-month LIBOR rose during the 6-month waiting period, hence the company will receive the settlement amount from the FRA seller. The settlement amount is calculated as follows:

Interest differential = (1.26222% − 0.95450%) × (182/360) × 1 000 000 $

Discounted at 1.26222% to the settlement date, the settlement amount the company will receive is:

= 1 555.70 $ / [1 + 1.26222% × (182 ⁄ 360)]

As a hedging vehicle, FRAs are similar to short-term interest rate futures (STIRs). There are however a couple of distinctions that set them apart.

| Interest rates fall | Interest rates rise | |||

| Party | FRA | Future | FRA | Future |

| Buyer | Loses | Gains | Gains | Loses |

| Seller | Gains | Loses | Loses | Gains |