Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

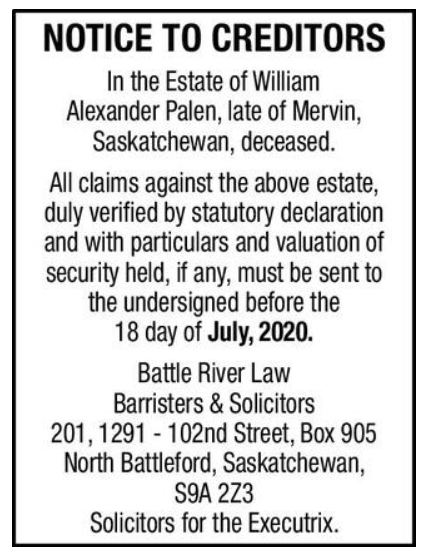

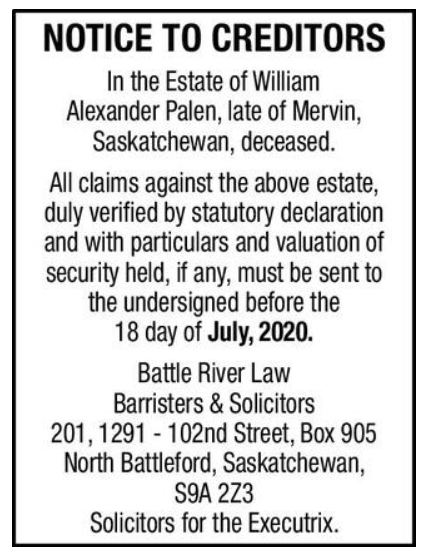

A notice to creditors refers to a public notice that is published in newspapers with a wide circulation, and it is addressed to creditors and debtors of the estate of a deceased person. The notice may run for several days or weeks, depending on the state requirements. The notice serves as a formal notification of all creditors and debtors of the deceased’s estate, and it requires them to appear in court to file claims or make corresponding payments to the estate.

Any person with claims in the estate of the deceased individual is required to file their claims within a specified period after the date when the notification is published. If a creditor fails to file their claim before the specified date, they will be barred from making any claims to the deceased’s estate. Notice to creditors is also used in bankruptcy proceedings to invite creditors to submit their claims.

A notice to creditors is a public notice filed by the appointed estate executor and is used to facilitate probate proceedings. The court appoints the executor named in the will, and the individual acts as the personal representative of the deceased’s estate. The executor is responsible for settling the outstanding debts owed by the deceased and collecting money owed to the deceased.

Also, the executor uses the notice to inform the public about the death of an individual and to alert potential creditors and debtors of the deceased’s estate. The notice gives creditors limited time to respond to the notice, and the notice period is usually indicated.

In the United States, there is usually a probate process of a deceased’s estate that is overseen by an executor. A probate process is the administration of the estate of an individual who died with or without a will. If the deceased wrote a will before his/her death, the custodians of the will are required to produce the will to the court within 30 days of the individual’s death. The court will then review the will to determine its authenticity and if it is admissible in court.

The court appoints an executor to collect the assets of the deceased, pay any liabilities that remain unpaid, and distribute the assets of the deceased to the beneficiaries named in the will. If the deceased did not write ave a will, the executor is charged with determining the beneficiaries and estimating the value of the estate using the date of death valuation or alternative valuation date.

When probate is opened, creditors are given a limited period of time to file their claims against the deceased’s estate. The executor can accept or reject creditor claims against the estate. If the executor rejects a creditor’s claim, the creditor can file the claim in court, and the probate judge will determine if the rejected claims will be accepted or rejected.

The executor is the personal representative that is appointed by the probate court to oversee all the deceased’s assets and determine their value using an accepted method specified in the Internal Revenue Code. The assets of the deceased individual that are subject to probate administration are placed under the supervision of the court, with the exemption of real estate. Real estate properties are administered according to the probate laws of the state where they are located.

Apart from receiving claims from creditors, the executor is required to settle any taxes owed to the government. For example, the executor is required to determine the final, personal income tax returns of the deceased for the tax year. After determining the actual value of the estate, and all taxes and debts owed to creditors settled, the executor seeks authorization from the probate court to initiate the distribution of the remaining assets of the deceased’s estate to the identified beneficiaries.

If the deceased individual did not leave a will, the executor is responsible for identifying all the potential legal heirs of the estate, including spouses, children, and parents of the deceased. The probate court will determine how the remaining assets will be distributed to the legal heirs.

A notice to creditors is also used to invite potential creditors when a person files for bankruptcy with the bankruptcy court. The notice is filed before the creditors’ first meeting, where all creditors with pending payments are invited to present their claims to the bankruptcy court.

The notice to creditors provides information on the creditors’ meeting and the requirement that creditors must provide proof of claim on or before the first meeting. Creditors who do not file their claims on or before the specified date are not allowed to make any claims on the assets of the debtor.

CFI is the official provider of the global Commercial Banking & Credit Analyst (CBCA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful: