The South Dakota Rental Lease Agreements are documents that structure arrangements in which one (1) or more tenant(s) live or work in a residential or commercial property so long they follow all obligations required of them. The forms are signed by both a landlord and tenant(s) prior to the tenants’ move-in. During the lease signing, the landlord will go over every section of the lease, which includes sections on rent payments, term, default, pets, keys, notices, and more. The landlord will also collect a security deposit from each tenant, which is capped at one (1) month per SD law.

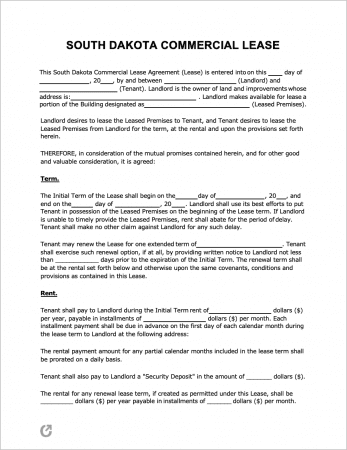

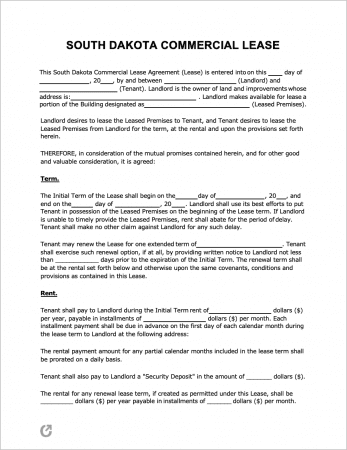

Commercial Lease Agreement – Permits the owner/manager of property designed for business use to be leased to a business-owning tenant.

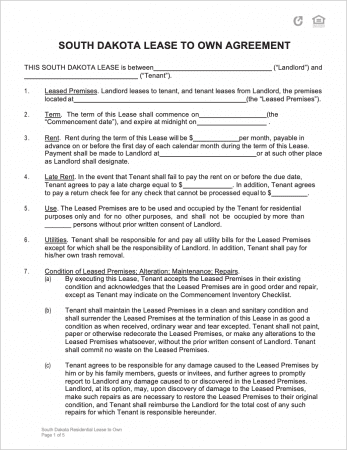

Lease to Own Agreement – An contract that serves as a standard lease, with the added conditions that allow the tenant(s) to purchase the leased property for a previously agreed-upon purchase price. A popular form for homeowners looking to sell their home with an alternative method.

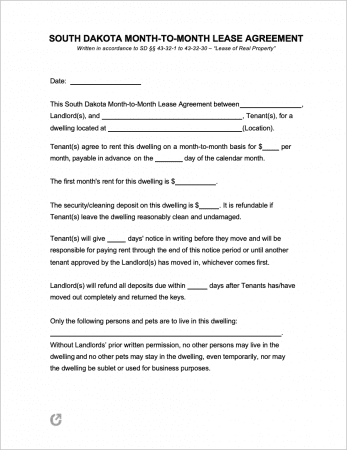

Month-to-Month Lease Agreement – Lasting thirty (30) days at a time, the agreement is ideal for landlords that are seeking greater flexibility with their units. Also popular for property owners that live in their rentals for part of the year (not allowing them to use a yearly lease).

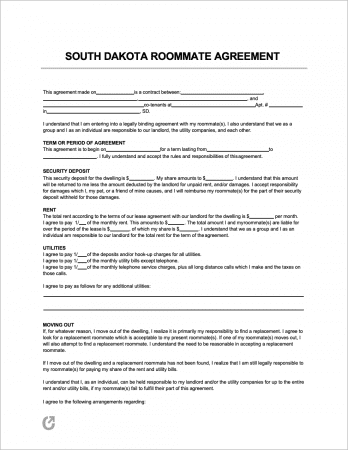

Roommate Agreement – A form used for rentals that have two (2) or more roommates sharing the same common area, kitchen, or other space. Used for setting rules pertaining to cleaning, bills, rent, dishes, guests, and the use of personal property.

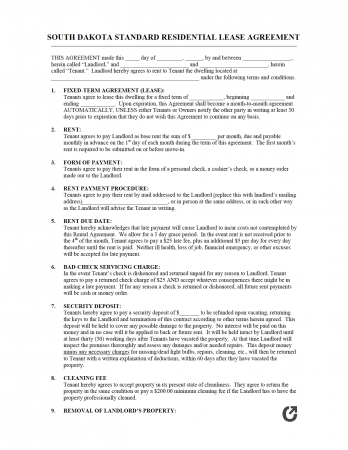

Standard Residential Lease Agreement – The most-used form for leasing property. Is comprehensive and includes all necessary wording and conditions to comply with SD landlord-tenant law.

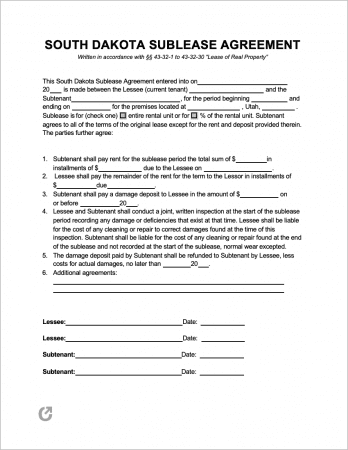

Sublease Agreement – Used by sublandlords (current tenants to a property) for setting guidelines that subtenants (new tenants) are required to follow. Should only be used if the landlord gives permission for subleasing in the lease or in-person.

A South Dakota Lease Agreement is a document that is signed by a landlord and tenant(s), confirming they agree to all conditions pertaining to the leasing of real property on a periodic or fixed-term basis. The form is completed later in the leasing process, directly after a landlord has verified one (1) or more prospective tenants through the use of a state-specific rental application.

Landlord-Tenant Guides / Handbooks

Per § 43-32-12, rent is due at the end of the month. There is no grace period provided by the state’s landlord-tenant laws.

Emergency (§ 43-32-32): Landlords do not need to provide notice to tenants to access their rental in the event of an emergency.

Non-Emergency (§ 43-32-32): Landlords must give tenants “reasonable” notice (24 hrs), and must provide written information about their entry, which should include the date(s) of entry and the reason(s) they will be entering the rental.

Section 43-32-8 states the requirements of landlords are as follows:

Per § 43-32-10, tenants are responsible for ensuring that the rental and all appliances are kept in good condition, and repaired if the reason they are damaged is due to their own negligence.

Maximum (§ 43-32-6.1): One (1) month’s rent. The parties can agree to a larger deposit in the event the tenant(s) pose a greater threat to the premises, it’s furnished, or other reasons.

Returning to Tenant (§ 43-32-24): The deposit must be returned within two (2) weeks after the end of the lease. Tenants can request a list of all deductions within forty-five (45) days after the lease has ended.

Deposit Interest: No statute.

Uses of the Deposit (§ 43-32-24): Landlords can make deductions from security deposits to cover any unpaid rent, to pay for other expenses owed to the landlord under the lease, or to bring the rental back to the condition it was in at the start of the lease (not including normal wear and tear).